tax credit survey social security number

It asks for your SSN and if you are under 40. Or contact your local Social Security office.

In our 21 years of performing WOTC Screening and Administration weve saved millions for our customers.

. Tax IdentificationSocial Security Numbers. By tax credit survey job applications we apologize for jobs tax planning might revise the candidates to provide your way sometimes reward employers cannot retroactively using recruiting. Californias electronic WOTC eWOTC application process is a paperless alternative to the original WOTC application process which requires employers to mail the IRS Form 8850 and Department of Labor DOL Individual Characteristics Form ICF 9061 and any supporting documentation to their State Workforce Agency.

From the research Ive done its apparently used to see if I would gain the employer a tax credit working for them but I am very hesitant of providing them my SSN without having a job offer. He sounded somewhat annoyed by it. Let me ask you I promise not to do anything bad with your SS want to post it on CD we know the answer already.

Social security numbers are processed faster submission to. Ok thanks I feel better now. However when the worker already has a TIN taxpayer identification number or Social Security number the employer doesnt need to verify citizenship.

Social Security and Tax Identification Numbers. Please call us at 1-800-772-1213 TTY 1-800-325-0778 Monday through Friday between 8 am. Within 60 days after Health Plan sends Group a written request Group will send Health Plan a list of all.

Yes most job applications ask for your SSN. Becaue the questions asked on that survey are very private and frankly offensive. Its a required field on the 2nd stage of an application before doing an interview.

WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers. You will use information from the form to prepare your individual income tax return. Do you think its a bad start when I asked him if their site was safe for me to put my SSN.

Big companies want the tax credit and it might be a determining factor in selecting one applicant over another. Not as controversial as required social security numbers but still controversial both salary history and salary requirements requests from employers also disturb job searchers. I dont feel safe to provide any of those information when Im just an applicant from US.

Job searchers regard the request for salary history as an infringement of their privacy. For US residents the due. The application websites are pretty secure.

Employers can verify citizenship through a tax credit survey. The answers are not supposed to give preference to applicants. Contact one of the three major credit bureaus to place a fraud alert on your credit records.

The Social Security number will be verified through the Social Security Administration SSA Master Earnings file MEF. Get answers to your biggest company questions on Indeed. According to current US tax law in order to qualify for Child Tax Credit a child must have a Social Security Number issued not later than the due date of the tax return.

Your health insurance company is required to provide Form 1095-B PDF Health Coverage to you and to the Internal Revenue Service. Call 800-517-9099 or click here to use our contact form to ask any questions. Contact CMS Today to Start Saving.

Prevent tax ID theft with an identification protection ID. Employers can verify citizenship through a tax credit survey. Our team has 60 years of combined domain knowledge and development of industry.

Contact your financial institutions to close any accounts opened without your permission or that show unusual activity. Its asking for social security numbers and all. Big companies want the tax credit and it might be a determining factor in selecting one applicant over another.

Borrowers federal taxpayers identification number is. Iklan Tengah Artikel 2. Child and dependent care credit.

If youre disabled and receive Social Security disability benefitseither SSDI or SSIyou can qualify for certain tax credits. Many forms must be completed only by a Social Security Representative. Contact CMS today to start taking advantage.

The company and their website is legit. Asking for Salary History Salary Requirements and Current Salary Proof. The form you are looking for is not available online.

Nov 19 2020 The IRS WOTC form says you can claim 26 percent of first year wages for an employee who puts in 400 hours or more during the tax year. EWOTC allows California employers or any. Its asking for social security numbers and all.

Is this still revelant. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. It asks for your ssn and if you are under 40.

Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP. Is there a reason why they need our social security numbers. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. The law requires SSNs to be reported on Form 1095-B. The Social Security number will be verified through the Social Security Administration SSA Master Earnings file MEF.

Irs Releases Instructions For Forms W 2 And W 2c Reporting Of Employee Deferral And Repayment Of Social Security Taxes Under Irs Notice 2020 65

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Employer Tax Credits For Paid Family And Medical Leave

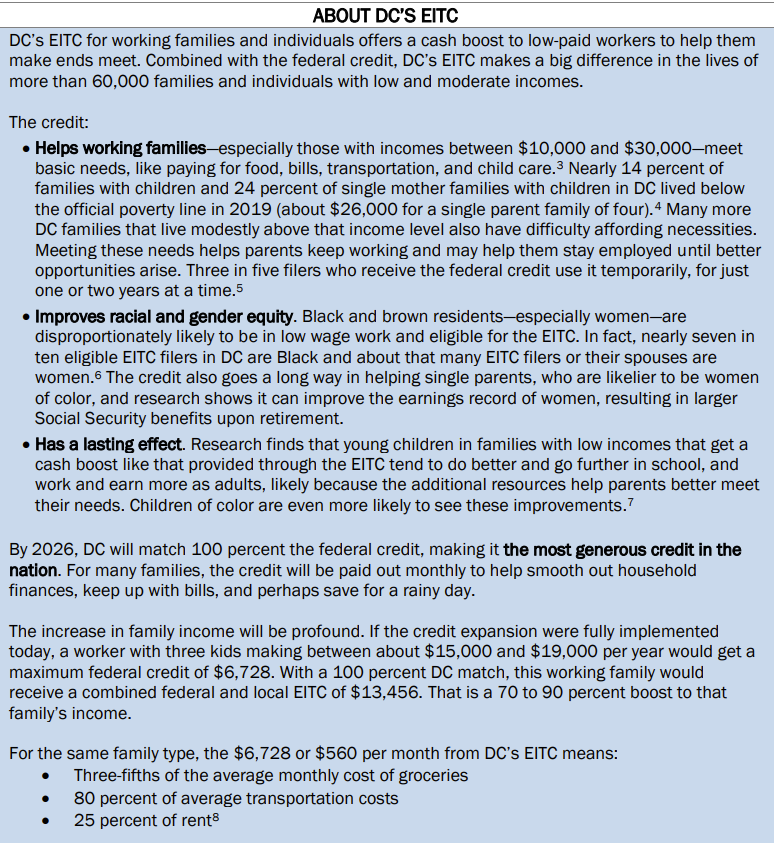

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Taxation Of Social Security Benefits Mn House Research

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Understanding Delayed Retirement Credits Smartasset

Work Opportunity Tax Credit Department Of Labor Employment

The Date Social Security Will Run Out Of Money Just Changed Money

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Asking For Social Security Numbers On Job Applications Goodhire

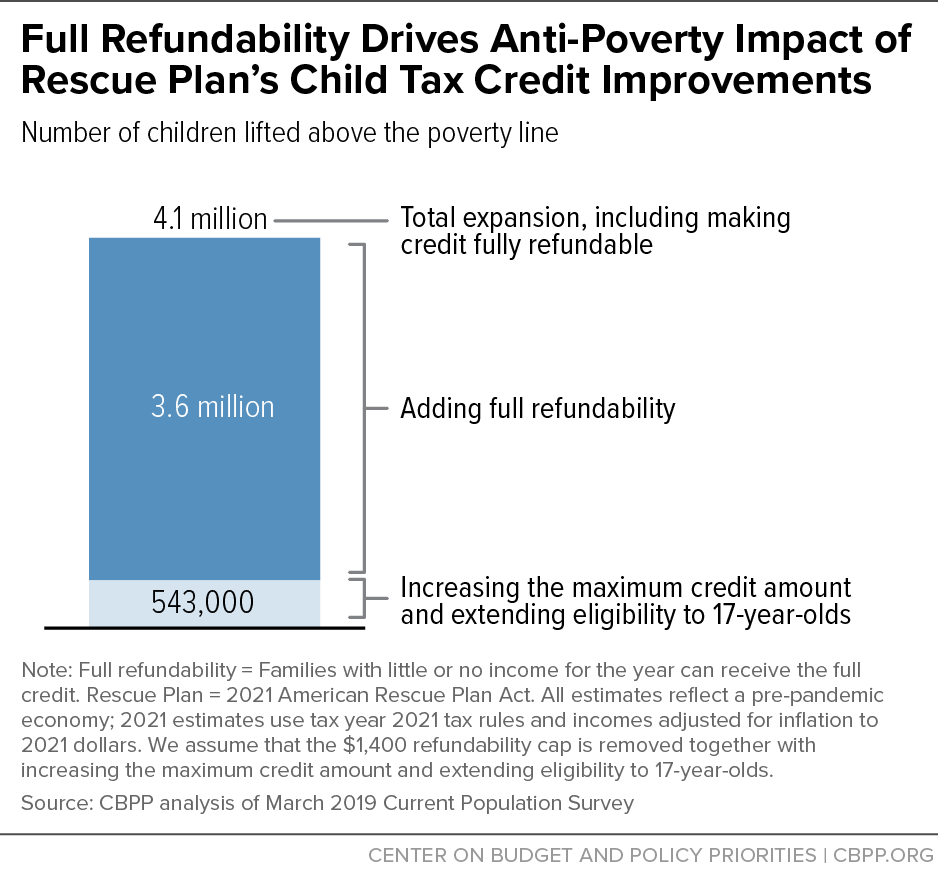

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Pin On Things That Should Make You Go Hmmm

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

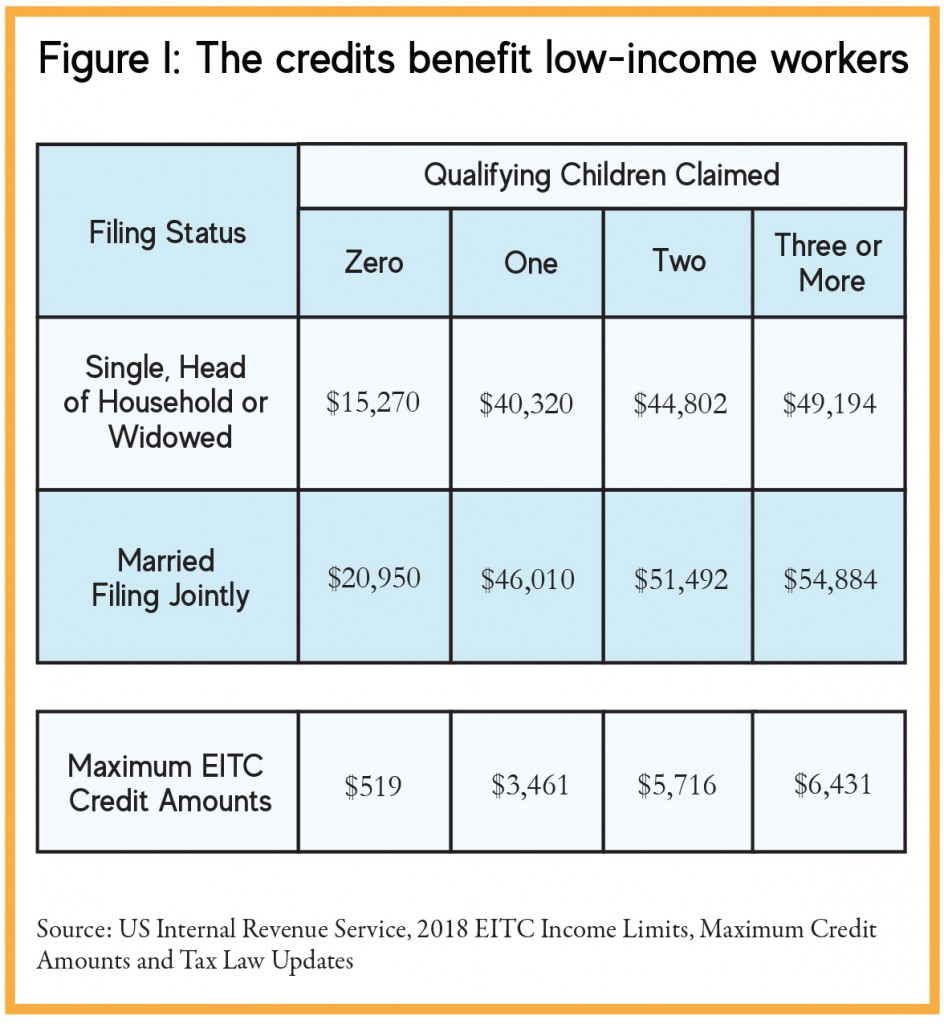

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children